Why Nobody's Talking About Open Banking Technology

Here's something your board probably isn't asking about anymore: open banking. Not because it failed. Because it won.

While everyone's chasing the AI narrative (and they should be), the infrastructure making that possible has gone quiet. Transaction volumes are climbing. Adoption keeps rising. But open banking has done something most technologies never achieve: it became boring. In the best possible way.

Open Banking Infrastructure

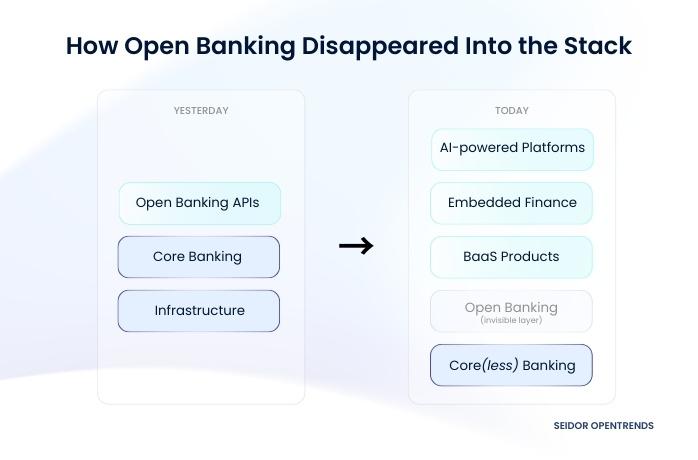

Open banking didn't die. It did what all successful infrastructure does: it disappeared into the stack. Think electricity, TCP/IP, cloud computing. Once it works reliably at scale, nobody talks about it. They talk about what runs on top of it.

Right now, that's AI-powered financial platforms, embedded finance, and Banking-as-a-Service. Increasingly, those platforms are being built on coreless banking architectures: modular, API-driven, and cloud-native by design. The experiences getting funded, the products making headlines, the platforms stealing market share, they're all running on open banking rails. They just don't call it that.

You know what your board is asking about? "For what are we using AI?" "What's our embedded finance strategy?" "Why are we losing customers to platforms that aren't even banks?"

Those questions are really about the infrastructure you already have access to but might not be leveraging correctly.

Why Silicon Valley Stopped Caring About Open Banking

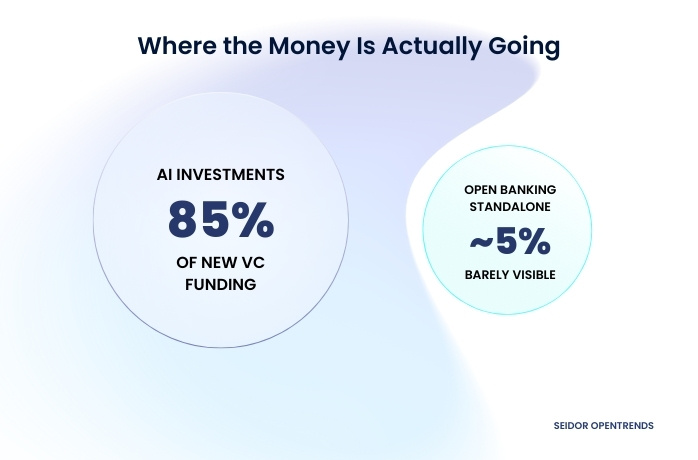

Capital tells you what matters. Right now, AI companies are pulling the vast majority of venture investment. Open banking startups? They're not even pitching standalone anymore. They're embedding it inside vertical SaaS, treasury tools, and lending platforms.

Silicon Valley no longer sees open banking as a product. They see it as plumbing. Necessary, commoditized, solved. The differentiation moved up the stack.

This should worry you if you're still treating open banking like a side project. Because while you're checking a regulatory box, your competitors are using the same infrastructure to rebuild the customer experience from scratch. More accurate. Fit to your business.

What AI Actually Needs (And Why Banks Have It)

Here's what nobody's saying loudly enough: AI can't eat financial services without high-quality, real-time financial data. And that data lives behind open banking APIs.

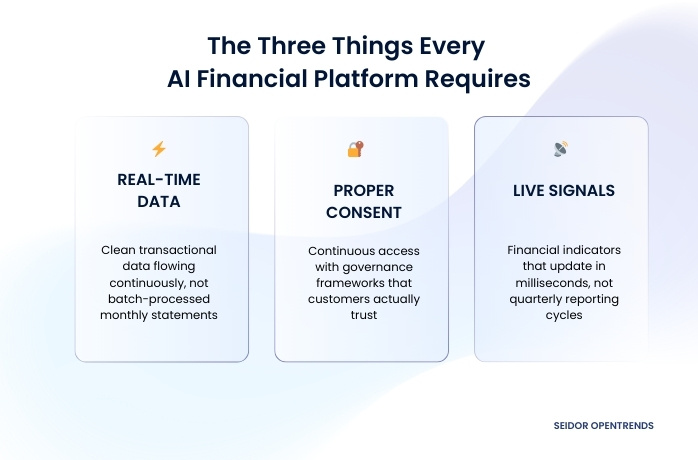

Every AI-powered credit model, every hyper-personalized financial assistant, every fraud detection system worth deploying, they all need the same three things:

- Clean, real-time transactional data

- Continuous access with proper consent governance

- Financial signals that update faster than quarterly statements

This becomes even more critical as financial services move toward agentic AI: systems that don’t just analyze data, but autonomously decide and act within defined guardrails. Agentic AI can rebalance portfolios, trigger risk controls, personalize offers, or initiate workflows, but only if it has continuous, trusted access to live financial data.

Open banking provides that access. But only if your architecture can actually feed those AI systems. Most can't. Because they were built for compliance reporting, not real-time intelligence.

Many banks still rely on legacy cores and batch‑oriented architectures that create data silos, inconsistent schemas, and limited real‑time processing, making it difficult to feed AI systems.

The institutions winning this transition aren't asking "should we do open banking?" They're asking, "How do we turn our open banking infrastructure into an AI-ready data layer?"

What Your Board Needs to Hear About Open Banking Infrastructure

When you walk into your next board meeting, here's the narrative that lands:

"We're not investing in open banking. We're activating the data backbone that makes our AI investments work."

Because here's the truth: your board already approved AI budgets. They're watching competitors launch embedded products. They're seeing platforms chip away at your customer relationships. What they're not seeing clearly is the connection point.

Open banking isn't the strategy. It's the enabler. But if your infrastructure can't support cloud-native scalability, real-time data pipelines, and event streaming, open banking data never enters the AI layer. In that situation, AI projects receive funding but lack the continuous, high‑quality data flows required to deliver meaningful results.

What Actually Matters Now in Open Banking

Stop treating open banking as a program. Start treating it as a platform capability.

The organizations getting this right are thinking in layers. Core banking stays stable. Innovation happens on top. Open banking becomes the interface between them, not a separate initiative with its own teams and budgets.

This layered approach is increasingly aligned with coreless banking models, where capabilities are composed, replaced, or scaled independently without destabilizing the foundation. This is how embedded finance platforms are eating traditional banking from the edges. This is how AI-native competitors are underwriting faster, personalizing better, and moving money more efficiently than institutions 100 times their size.

They're not smarter. They just built their infrastructure correctly from day one.

The Window Is Narrower Than You Think

Here's what keeps us up at night: the gap between "we have open banking APIs" and "we're operationally ready to compete in an AI-first market" is massive. And it's growing.

Every quarter you spend treating open banking as a compliance exercise is a quarter your competitors spend turning it into a competitive weapon. The difference isn't philosophical. It's architectural.

Banks that recognize this are redesigning their approach. Not replacing their core systems overnight. Not launching yet another digital banking app. They're treating open banking infrastructure the same way cloud infrastructure was treated a decade ago: as the foundation on which everything else depends.

The institutions that figure this out will own the intelligent financial services layer. The ones that don't will keep asking why their AI initiatives never quite deliver the promised ROI.

From Open Banking to AI-Ready Execution

At SEIDOR Opentrends, we see the same pattern across financial institutions: open banking APIs exist, cloud investments are underway, and AI budgets are approved yet the pieces don’t operate as a system.

Our AI Stack Starter™ was built to close that gap. It is not an innovation lab, a proof-of-concept factory, or a one-off AI deployment. It is a structured, production-oriented foundation that turns open banking use case data into an AI-ready operating layer: designed for real decisioning, real customers, and real scale.

It supports modern, coreless banking-style architectures, where intelligence lives above the core and capabilities are composed rather than hardwired. It enables agentic AI to operate safely and effectively by ensuring continuous data flows, real-time execution, and architectural guardrails are in place from day one.

AI Stack Starter™ provides the connective tissue between infrastructure, intelligence, and execution, using assets you already have and structuring them in the way the market now demands.

The competitive advantage does not come from adopting new technology. It comes from activating the stack correctly.

Let's build it. Contact SEIDOR Opentrends

FAQs about Open Banking Infrastructure for AI

What is open banking infrastructure, and why does it matter for AI?

Open banking infrastructure provides secure, consent-based access to real-time financial data through APIs. This data is essential for AI systems that support credit decisioning, fraud detection, personalization, and embedded finance. Without a scalable, event-driven architecture, open banking data remains trapped in compliance or reporting layers. Institutions that treat open banking as an AI-ready data backbone are better positioned to operationalize AI, rather than limiting it to isolated pilots or batch-driven analytics.

How does open banking support agentic AI in financial services?

Agentic AI systems act autonomously within defined guardrails, making and executing decisions in real time. In financial services, this requires continuous access to high-quality transactional data, strong consent governance, and low-latency data pipelines. Open banking enables that access, but only when paired with cloud-native architectures that support real-time ingestion and event streaming. Without this foundation, agentic AI cannot operate safely or effectively at scale.

What is coreless banking, and how does it relate to open banking and AI?

Coreless banking is an architectural approach that replaces monolithic core systems with modular, API-driven services. Instead of centralizing all functionality in a single core, capabilities are composed and scaled independently. Open banking often becomes the interface layer in this model, exposing data and services to downstream platforms. This architecture is better suited for AI-driven use cases, as it supports real-time data access, composability, and faster innovation without destabilizing core systems.

How does SEIDOR Opentrends help banks become AI-ready using open banking?

SEIDOR Opentrends helps financial institutions activate existing open banking investments through its AI Stack Starter™ approach. Rather than focusing on proofs of concept or isolated deployments, the program serves as foundation to align data access, cloud-native architecture, and AI execution into a production-ready operating layer. This enables real-time decisioning, supports modern coreless-style architectures, and ensures AI initiatives are fed by continuous, governed data flows that connect strategy directly to measurable business outcomes.