Opentrends Presents Metaverse Opportunities for the Financial Sector

PRESS RELEASE

PALO ALTO, Calif. – April 21, 2022 – The international digital transformation firm Opentrends, Inc. speaks to the untapped metaverse challenges and opportunities in the financial and banking sector. A new interactive webinar ‘’Metaverse: challenges and opportunities in the financial sector’’, April 21 at 9 a.m. PDT/ 12 p.m EDT, organized alongside the Financial Studies Institute in Barcelona (Institut d’Estudis Financers - IEF), examines the opportunities the metaverse offers to bank and financial institutions.

Join industry experts Ferran Teixes (IEF CEO), Carles Roca (Senior Account Manager for US and Europe at Opentrends), and Xavi Buscallà (CEO of Opentrends Inc.) as they share current market data, the latest available technologies, and some of the most impactful use cases to date.

Beyond the Buzzword: Why Now Matters

The metaverse isn't a novel concept, but its relevance is high. Buscallà emphasizes, "We want to demonstrate the advancements that make the metaverse a game-changer for finance." This webinar isn't just theoretical; it's about harnessing the power of AI, blockchain, cloud computing, and augmented reality (AR) to create a more immersive and efficient financial experience.

Tailored for a Tech-Savvy Generation

A tech-savvy generation—millennials and Gen Z — is reshaping the financial landscape. These digital natives are accustomed to video conferencing, virtual gaming environments, and the promise of web 3.0, a decentralized internet. The metaverse aligns perfectly with their expectations, creating fertile ground for innovation in banking.

Webinar Agenda

- Metaverse taxonomy and the differences between the metaverse, multiverse and omniverse

- Showcasing different realities: real-life environment simulation, virtual environments and mixed-reality simulation

- The Metaverse's seven layers

- Case studies include client relationships, PR, learning/training, AR, and onboarding for eCommerce, showrooms and more.

- Legal implications

Metaverse Roadmap for Banks

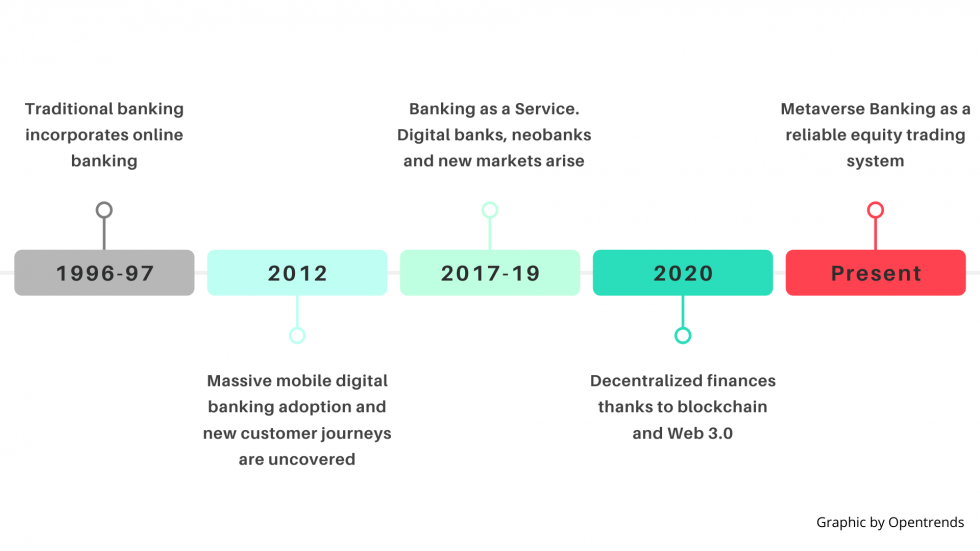

The traditional brick-and-mortar model is giving way to a digital future. This webinar unveils a potential roadmap for banks to navigate the metaverse, outlining how to integrate emerging technologies into their existing infrastructure. As Buscallà points out, "Open Banking is just the beginning. We're on the verge of Metaverse Banking, a whole new era for customer experiences." Here's a potential roadmap:

‘’Open Banking isn’t yet fully implemented and we’re already going further’’, asserted Xavi Buscallà, and continues ‘’We’ve seen the introduction of digital banks, neobanks and new markets; and now we’ve entered the Banking as a Service era, more specifically the ‘’Metaverse Banking’’.

Shaping the Future of Finance

Opentrends and IEF's financial experts will explore the need for a robust economic system within the metaverse, encompassing equity trading, digitized processes, and novel customer journeys. The webinar will demystify decentralized finance powered by blockchain and web3.0, along with non-fungible tokens (NFTs) and digital assets. It will showcase how leading institutions like Bank of America, Citibank, JP Morgan Chase, and the New York Stock Exchange are already embracing these advancements.

About Opentrends

Opentrends, Inc. is an international digital transformation firm with clients such as Sony, Fujitsu, BBVA, Grifols, Mitsubishi Electric, Volkswagen, Honda, and other Fortune 500 companies. Located in Palo Alto, Barcelona, Madrid, and Kerala, Opentrends provides custom software development and integration, implementation, and adoption of advanced technological solutions.

Press contact

infous@opentrends.net

http://www.opentrends.us/en

SOURCE Opentrends Inc

Related Links

www.opentrends.us

https://www.linkedin.com/company/opentrendsus