VerticalVerticalVertical

Banking and Financial Tech Services

The Importance of Digital Transformation in Banking

As traditional banks and financial service companies grapple with market pressures, rising regulatory scrutiny, and the omnipresent threat of cybersecurity risks, our software development firm stands at the forefront of innovation.

The way people use banks is changing. The rapid evolution of customer expectations in today's fast-paced digital world has reduced foot traffic in physical branches and introduced non-traditional competitors and disruptors. We recognize these challenges as opportunities to transform the financial sector.

Our Expertise in Financial Technology

We empower banks and financial institutions with cutting-edge technology solutions that work for them, reshaping financial engagement for the digital age. We specialize in creating securely robust software solutions for banking, financial and insurance institutions. Our firm has played a pivotal role in developing major European banking software infrastructures, serving millions of users and solidifying our expertise in the sector.

Areas of Expertise:

Banking Transformation

- Utilize cloud computing to modernize core banking systems, accelerating development and scaling applications.

- Drive innovation and adaptability through multi-cloud solutions, data democratization, and open banking adoption.

- Streamline manual processes across lending-related documents, workflows, underwriting, and loan origination procedures.

UX/UI Omnichannel CX for Finance

- Adopt a user-centric approach to design intuitive and user-friendly financial applications, portals, and gamification solutions.

- Enhance user satisfaction, engagement, and loyalty by delivering consistent and delightful experiences across various channels, including mobile banking apps, websites, third-party apps, and in-person interactions.

- Design System for finance

Digital Banking Technology

- Full stack to craft user-friendly digital portals, apps, and advanced AI chatbots.

- Create and integrate fully digital banking products and experiences targeting specific demographics, such as Millennials and Gen Zs.

FinTech Innovation

- Seamlessly integrate AI, data analytics, and automation to create novel solutions for digital payment processing, online banking, P2P and digital lending, cashback rewards, cryptocurrency, blockchain, and BFM.

We are dedicated to delivering top-tier products and services to our customers while upholding the highest standards in the banking and financial sector encompassing data privacy, cybersecurity, financial practices and governance. These include but are not limited to:

- ISO/IEC 27001

- NIST 800-53

- PSD 2

- ASPSP

- FCRA

- GLBA

- ISO 20022 (2025)

- Money Laundering Regulations - UK

Financial Industry: What sets us apart

We Deliver What Others Can’t

Orchestrated complex architectures for developing mission-critical financial applications within multi-vendor environments.

Vendor-agnostic and Multi-cloud Choice

Develop once, run anywhere, access everywhere. Our cloud options include Azure, AWS, GCP, IBM IKS, Openshift, hybrid solutions, and cloud-native platforms. We nurture an extensive tech partner network, including:

Our Strength. Your Advantage

Strong experience in complex architectures, CI/CD, agile DevOps-managed services for financial players.

Fully Integrated Digital Agency

70+ digital experts in fintech portals, mobile apps and gamification recognized by industry rewards including BAI global Innovation and The Banker.

Committed to Sustainability and Security

100% renewable energy, zero net carbon emissions, and a security-first approach.

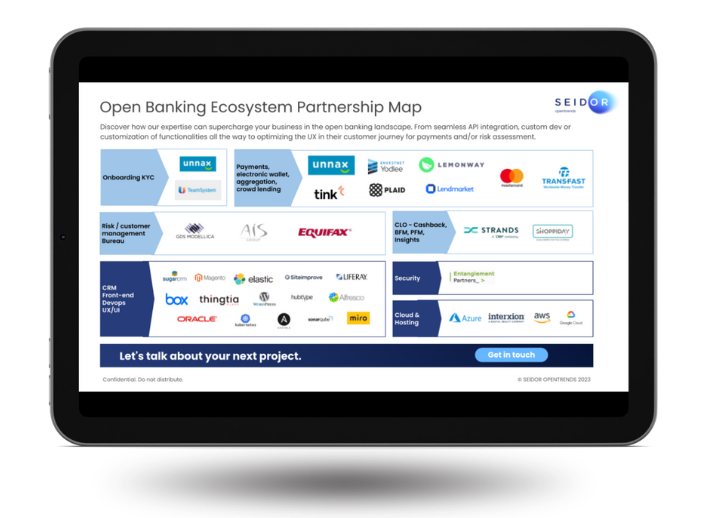

Open Banking Ecosystem Partnerships

Discover how our expertise can supercharge your business in the open banking landscape:

- Seamless API Integration

- Custom developments and functionality customization

- Enhanced User Experience

Download SEIDOR Opentrends Open Banking Ecosystem Partnership Map

Some Banking and Financial Client Stories

Revolutionizing Hercules Capital's document management processes with a cloud-based DMS powered by Box, boosting productivity during COVID-19. Read more

Digital Transformation for a Venture Capital

Pioneering a custom private cloud system in 2014 for a major European bank reduced deployment time from two months to two days, solidifying its position as the top institution. Read more

Highly secure cloud infrastructure

Created Europe's first fully digital bank for Millennials and Gen Zs, earning accolades for best user experience financial app, outperforming competitors like Revolut, N26, and Rebellion Pay. Read more

Neobank's Brand and Portal Design

Hubtype-powered AI Chatbot in a mobile banking app transformed user experiences with personalized retail discounts, setting a global trend. Red more

Banking industry first-ever chatbot

SEIDOR Opentrends' mini-games increased the neobank's app downloads and engagement, becoming the top consumed in-app content. More on our gamification strategy

Gamification Growth Strategy for a Neobank

Addressing the need to harmonize the creative and technical aspects of digital product development, SEIDOR Opentrends established a design system for a leading financial institution, streamlining development processes and ensuring consistent user experiences.

Design System for a financial institution

Discuss your needs with our expert team.